|

| Know how to connect your BPI account to a GCash number and transfer funds this 2021. Just read this updated and latest guide. LOGO: BPI and GCash |

If you're looking for a way to transfer or cash in money to your GCash account without going outside your place, you're in the right place!

Since the pandemic started, many people have relied on mobile banking apps and e-wallets such as GCash. Because it is easy to use where people can buy what they want through online means, they can also transact cashless, which is a big help to maintain minimum health protocols.

Transferring money to GCash is easy if you already have a Bank of the Philippine Islands (BPI) account. To do this, you must open a bank account first with the said bank. Once you have an account, you can access the online banking features of BPI through their mobile app, where you can quickly transfer money to a GCash account.

There are actually two ways to transfer money from BPI to GCash, one is through the GCash "cash-in" feature, and the other is through BPI's "load e-wallet" option. Know it here!

{tocify} $title={Table of Contents}

Why use BPI to transfer money to GCash?

BPI is the best option to transfer money to GCash since both mobile banking services are owned by the Ayala conglomerate. This means that they are interconnected, and a GCash account holder can link a BPI account to quickly transfer funds or cash in.Moreover, on the BPI app, one can quickly transfer money to any e-wallets, including GCash. A person just needs to have the GCash number of the target recipient and then enter the desired amount they want to transfer.

According to data firm App Annie, BPI and GCash were the top choices of Filipinos last year, 2020, for mobile banking apps.

According to data firm App Annie, BPI and GCash were the top choices of Filipinos last year, 2020, for mobile banking apps.

What are the requirements to transfer money?

As mentioned above, you need to have a (1) BPI account, and a (2) fully verified GCash account. Once you have a BPI account, you can use it to transfer money to GCash. For other requirements, you must have a (3) stable internet connection to avoid errors in your transaction and a (4) mobile number which you might need to get a one-time-pin (OTP) code.

Note: If you want to transfer your money from BPI to GCash, you first need to connect both accounts. Once the two are linked, you can transfer money within the GCash app using your BPI account.

How to link my BPI account to GCash?

If you want to transfer money directly to your GCash account without logging in to other mobile apps, you can do this by linking your BPI account. Just open your GCash app, then go to "profiles," and click on "my linked accounts." From there, just look for BPI and then link your account by entering your username and password.

You may also follow the easy and simple steps below:

1. Open your GCash account.

So you need to upgrade your GCash account to enjoy its features fully, including in-app money transfer via a BPI account.

2. Tap on the "Profile" menu

Once you can log in to your GCash app, you must click on the "PROFILE" button to access the account menu. It can be seen on the bottom part of the app alongside the "HOME," "QR," and "ACTIVITY" buttons.

Said buttons have different features: the Home button acts as a toggle to go back to the main page, the QR button is where you can generate or scan a QR Code, and the activity button is where you can see all of your transactions.

Just directly click on the profile button to start the actual process of linking your BPI account to your GCash account.

3. Click on "My Linked Accounts"

In the profile menu, you will see many options. Click on "MY LINKED ACCOUNTS" to continue the process of linking your BPI account to your GCash account.

Other features listed in the profile menu include "my QR codes," "GScore," "promos," "voucher pocket," "partner merchants," "refer friends," "settings," and "help" center.

4. Select BPI and log in to your account

After you click on "MY LINKED ACCOUNTS," select BPI and then log in with your username together with your password. Click on the "ACCEPT" button to complete your registration. There is no need for a one-time pin (OTP) for this process.

5. Successfully link your BPI to GCash

Finally, you completed the process for linking your BPI account to GCash. An email notification will be sent to the registered email connected to your BPI.

You can now start to fund your GCash from your BPI account directly.

How can I transfer money from BPI to GCash?

To transfer money from BPI through the GCash app, just log in to your account. Then tap the BPI logo under "MY LINKED ACCOUNTS" or "ONLINE BANKS" and enter the desired amount you want to transfer. Once you're done inputting the amount, click on "NEXT" to continue and confirm the amount.

Enter the authentication code or OTP sent to the mobile number connected with your GCash account. Once done, you will receive the amount in your GCash wallet. You may also follow the five (5) easy and simple steps below:

1. Log in to your GCash account

Make sure to log in securely to your account, and no one knows the MPIN besides you. If you forgot your MPIN, just tap on the "HELP CENTER" or "Forgot MPIN?" which can be found on the bottom of the log-in screen.

2. Click "CASH IN" and tap the BPI logo

After you log in to your GCash account, click the "CASH IN" button on the homepage. From there, you will be redirected to several options on how to cash in. Look for the BPI logo (usually, it is under "Online Banks" and "My Linked Accounts" categories) click it to proceed with your BPI to GCash transfer money request.

3. Enter the desired amount you want to transfer

4. Get the OTP code and enter it to continue

After you confirm the desired amount, click on the "SEND CODE" button to get a 6-digit authentication code (OTP) that will be sent via SMS to your BPI-registered mobile number.

|

| An OTP code will be sent to your BPI-registered mobile number to verify your transaction. |

Once received, enter it on the required field and click on the "SUBMIT" button to continue.

5. Instantly receive the amount to your GCash

Finally, you will receive the transferred amount from your BPI to your GCash account. A message will pop up in the app that says, "BPI to GCash Cash-In Received!" It means your transaction is successful.

You will also receive a confirmation message on your BPI registered mobile number and email address. Said message will act as proof for your BPI to GCash transaction.

How to transfer money via BPI mobile app to GCash?

If you're not able to link your accounts, there is still another option to transfer money from your BPI account to a GCash number. Just open the BPI mobile app, log in to your account, and go to the account menu. From there, click on "Payment/Load" then "Load E-Wallet" and choose GCash.

To continue, enter the GCash account number on the "Reference Number" field and put the desired "load" amount. Click on "NEXT" and then input the OTP code you receive via SMS. Lastly, click on the "CONFIRM" button and receive the desired amount on your GCash account.

You may also follow the easy and simple steps below on how to transfer money via BPI mobile app to your GCash account:

1. Open your BPI mobile app and log in to your account

Note: Only BPI account holders can use the said app. If you don't have a BPI account, you may open one just by clicking "OPEN AN ACCOUNT NOW" on the home screen of the app.

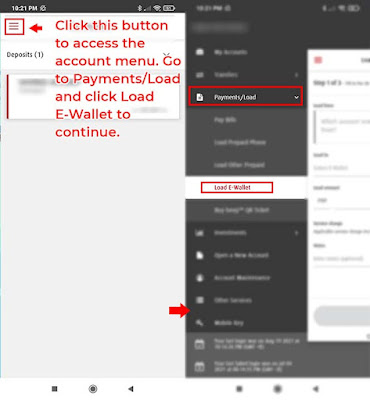

2. Select "Payments/Load" then "Load E-Wallet"

Go to the account menu by clicking the three dash lines as seen in the image above. After you click it, you will see a list of options, go to "Payments/Load" and then choose "Load E-wallet." Make sure that your account has an available balance to be able to continue your transaction.

3. Choose an account to load from and fill out the form

You might have two accounts on your BPI account. Choose the account that you want to load from. In the image above, "SAVINGS ACCOUNT" has been chosen since it's the only account of the owner. Afterward, tap on "SELECT E-WALLET" and then select GCash from the options provided.

Input the desired amount you want and put the target number or GCash account on the "Reference Number" (which will appear once you choose the e-wallet you prefer) to continue. You may also put a note or message for the transaction.

If you have other e-wallets or finance apps aside from GCash, you may also use BPI to transfer money, particularly to: Paymaya, Beep, EasyStrip, Auto sweep RFID, DBIZ Pay, and GetGo.

4. Review details and click on "confirm"

Once you're done filling out the required filled, you must click on the "NEXT" button (as seen on the image above) and then review the details, then click on "CONFIRM" to continue. You will receive an OTP code on your BPI-registered mobile number to verify your transaction.

5. Enter OTP code and then click submit

After you confirm the details and receive an OTP code, enter it on the required filled and then click on "SUBMIT." If you didn't receive a code, click on "Resend code via SMS." Once you are done with the transaction, you will receive an in-app receipt saying that your "Load e-wallet was successful," as seen on the image below:

You will also receive an email notification for the successful BPI to GCash transfer money transaction:

A message via SMS will also be sent to the GCash-registered number notifying the account holder of a successful transfer money transaction via the BPI mobile banking app. The message is usually like this: "You have received P 500.00 on 08-19-21 06:50 PM from BPI account ending 8890. Your new balance is P 500.00 with Ref No. 60006974890031. Thank you."

How much is the transfer fee from BPI to GCash this 2021?

If you will be directly transacting through the GCash 'cash-in' feature and BPI mobile app via the Load E-wallet features, the service is FREE-OF-CHARGE, and there's no need to pay any amount. You may also check the details of the transactions below, which shows the service fee/charge of BPI to GCash transaction is free.

How much is the transfer limit for BPI to GCash transactions?

According to BPI, the daily transfer limit is Php 50,000 per target account (which means you can only send Php 50,000 per GCash number.) This includes fund transfers to unenrolled accounts, e-wallets, bank accounts, payments, and other available mobile transactions.

For the transaction limit, including funds transfer from BPI to GCash, you may check the table below:

| Funds transfer to GCash | |

|---|---|

| Minimum Amount | Php 1 |

| Maximum Amount | Php 50,000 |

| Daily Limit | Php 50,000 per GCash account |

For the GCash account that will receive money from sources like BPI, here are the transaction limits according to their website:

| Type of Account | GCash Wallet Limit |

|---|---|

| Basic GCash Account | Php 50,000 per month |

| Fully Verified GCash Account | Php 100,000 per month |

| Enterprise Account | Php 500,000 per month |

Conclusion

It's easy to link a BPI account to GCash and send money through their "load e-wallet" and "cash-in feature," respectively. Through this method, there's no need to go out and transact physically. It is also helpful in these times of pandemic to mitigate the spread of any diseases, including COVID-19. So it's better to open a mobile bank account, especially if you are the type of person who enjoys paying through online means.

For other information and inquiries about transferring money from BPI to GCash, you may contact the following: +63 2 889-10000 (international calls), 02 889-10000 (domestic calls), 1-800-188-89-100 (PLDT domestic toll-free), and help@bpi.com.ph (email address). —iTacloban